Table of Contents

Imagine, for a second, that I hand you a dart and blindfold you. Then, I lead you into a room, spin you around five times, and tell you: “The bullseye is somewhere in this room. Toss the dart and see if you can hit it.” Then, I take cover behind a couch, so you don’t fling the dart into one of my eyes.

What are your chances of actually hitting the bullseye?

Now imagine that once we pull the dart out of whatever lamp or unfortunate pet you flung it into, I remove the blindfold, hand it back to you, and say: “Now get this thing into the bullseye however you want.” Then, you walk up to the target and push the dart right into the center.

That’s the difference between trying to find your true fans with and without well-researched buyer personas.

Today, we’ll teach you how to create them from scratch.

Why listen to me?

For my whole career, I’ve worked in and grown small businesses. In the past 5 years, I’ve conducted more than 500 customer interviews on behalf of more than 20 clients. I’ve also participated in hundreds of research sessions as an interviewee through User Interviews. You can connect with me on LinkedIn here.

TL;DR

Buyer personas are semi-fictional avatars of your ideal customers.

Creating buyer personas starts with doing market research (gathering quantitative and qualitative data about your customers through surveys, analytics tools, and interviews).

Buyer personas help you understand your target audience's needs, goals, pain points, and decision-making processes.

Ideally, buyer personas should inform your marketing, sales, product development, and customer service.

Leveraging tools like Surveymonkey, User Interviews, and beehiiv polls can help you gather great data and create buyer personas that aren’t just fluff.

Regular updates, cross-functional collaboration, and persona-driven decision-making are key to making sure that the effort you’ve put into creating buyer personas isn’t wasted.

DANGER: If your buyer personas are based on assumptions and not on the data you’ve collected, you’ve wasted all of your time and effort.

Buyer Persona Research

If you were a talented Italian chef, would you rather:

Throw loose spaghetti into a crowd of mostly gluten-free people to see who wants it?

OR

Walk up to the person in the crowd who actually likes and wants spaghetti and hand them a plate of your delicious creation?

Looking at the giant hungry crowd of people that is the internet, how can you tell who actually wants spaghetti?

You start by asking people: “Who wants spaghetti?” (This seems simple and silly, but there are a lot of businesses out there trying to metaphorically force-feed spaghetti that nobody asked for to crowds of strangers).

So how do you find people who want your spaghetti? You ask around!

First, we ask who wants spaghetti and why they want it (market research). Then, we plot all of the reasons they wanted spaghetti and the ways they got it and create avatars of our ideal spaghetti-eaters based on the data (buyer personas). Finally, we use what they’ve told us to make even better spaghetti for them (customer feedback loop).

If we do a great job at those three steps, we’ll create a fanbase of loyal people who will recommend our spaghetti to their friends forever.

Let’s break down that first step – asking around (market research).

Conducting Market Research

Market research is simply the process of uncovering who’s in your target market (i.e., NOT gluten-free people), discovering why they want to buy spaghetti in the first place, and then making a plan to tell them why they should buy your spaghetti instead of the gross inferior spaghetti that your competitors make.

There are a few big-picture questions you need to answer in any market research campaign.

Who are we targeting, and why do we want to reach them?

Are we going to talk to them individually or all at once?

How will we find these people?

How can we make sure the time we spend is valuable?

What will we offer respondents for their time?

How much money are we ready to spend?

What’s our plan for using the data we collect? (I know it sounds obvious, but I've seen several companies gather data and never use it.)

I went into each one of these more in-depth in my previous article on market research.

The three primary ways to answer the above questions are through surveys, focus groups, and one-on-one interviews.

Surveys

Surveys are a great way to talk to a lot of people and gather a lot of data.

If you have a budget already set aside and you’re ready to roll, here are a few tools that I recommend:

If you’re boot-strapping and you’re trying to get some good data on a shoestring (trust me, I’ve been there, too), here is what you should do to get survey respondents AND set up interviews for free:

Create a SurveyMonkey survey (on a free trial) or Google Form (always free).

Find forums where people talk about products in your market. Facebook groups are great, as are Reddit threads or forums on competitor websites. There’s a forum for everything. I guarantee that you can find one.

Post in these threads about how your product is better than what they’re used to (ask if anyone’s willing to help you make the world’s best spaghetti).

Ask anyone who answers you if they’d be willing to take a survey to help you make spaghetti so good that it will change their lives.

Send them your survey and collect the info from anyone who answers.

Re-target the people who provided their contact info in the survey. Ask them if they’d be willing to talk to you in a group or one-on-one in exchange for a free product sample.

When writing surveys, there are a few things that you need to be aware of. Here are some survey best practices:

Meticulously review your questions for any biases that might influence answers before publishing. This one is difficult and takes some self awareness. As you're writing your survey, think to yourself: "Am I asking this question because I want a certain answer, or is this a truly objective question?

Mix up the types of questions you use. No one wants to sit there and answer 50 multiple-choice questions. Our college entrance exams are over! Make sure that you include true/false questions, ranking questions, single answer/multiple answer multiple choice, and ranking questions.

Eliminate repetitive questions. No one wants to answer the same question phrased 100 different ways. Be respectful of whoever is taking the survey and be succinct and non-repetitive.

Adjust the sequence of questions randomly for each respondent. People are influenced by question order. Each question psychologically influences the next question. Randomizing questions will help avoid this! Most major survey platforms will allow you to randomize.

Refine and edit your questions. Cut, cut, cut. Make sure that each question is cut down to its bare essence. People are busy, and will be frustrated with fluffy, confusing questions.

Avoid bombarding your respondents with too many questions.

If your survey takes longer than 15 minutes, most people will not complete it. Think about the data that you absolutely need and cut anything that doesn't get you that.

Struggling to think of useful survey questions? Here are 16 straightforward ones that will help you create an effective buyer persona later:

Personal Background Questions (Demographics)

What’s your current marital status?

Can you specify your gender?

Do you have children?

What level of education have you achieved?

What’s your age?

Career Profile Questions

Which sector does the company you work for operate in?

What position do you hold, and what is your job title?

What tools do you regularly use in your profession?

What specific skills are necessary for your role?

How long have you been working in your current role?

What is the size of your company in terms of employee count?

Preference Questions

Do you research vendors or products online before making a purchase?

How did you make the decision for your most recent purchase?

What’s your preferred way to interact with vendors (e.g., email, phone, face-to-face)?

What social media platforms do you use most frequently?

Which blogs do you find most relevant to your interests or profession?

Focus Groups

Focus groups allow you to go a little bit deeper with people in your target market than surveys. With real-time conversation with a group, you can easily tease out insights and hear real-time feedback that you would not get with a survey.

Focus groups can be expensive. If you have a decent budget, I’d once again recommend using Respondent or User Interviews to set up a group to speak to in your target market.

If you don’t have a large budget, you can do something similar to what I’ve outlined above. Reach out to people in forums and offer them free products in exchange for speaking with you!

There are things you need to watch out for when running focus groups. It's easy to waste a lot of time and not actually gather useful information. If one person monopolizes the conversation or if the moderator is biased towards one opinion, you’re not going to collect useful data!

Here are some best practices to make sure that your focus groups are actually useful:

Select a Skilled Moderator: Choose someone experienced in guiding discussions without influencing opinions. The moderator should have experience keeping conversations neutral.

Plan Your Data Analysis: Have a straightforward plan for analyzing the feedback, making sure that you can tell individual opinions apart from the group's overall view.

Get a Diverse Group: Your participants should reflect the wider population you're interested in, not just those who already know and like your product.

Control Group Dynamics: Set rules to prevent one person from dominating the discussion UP FRONT. Encourage everyone to share their thoughts equally throughout the group.

Be Ready To Adapt: Monitor the focus group's progress and make changes, if necessary. This could mean tweaking your questions mid-conversation or adjusting the group setup based on participants' comments.

Focus groups are much harder to schedule than one-on-one interviews and take a very skilled moderator to pull off. If you’re new to market research, I’d recommend starting with one-on-one interviews and working up from there!

One-on-One Interviews

My bread and butter! I love one-on-one interviews. I've conducted hundreds of them in my career, and I've sat in quite a few as a respondent through User Interviews.

The level of depth that you can reach in an interview is just so much better than with a survey or focus group, and the selection process for interviews filters out time-wasters far better than that for surveys and focus groups.

Many respondents who take surveys rush through them or provide inaccurate information just to get their incentive. I’ve certainly done it.

Focus groups are a little better, but you still don’t know if you’re getting the best information. I once faked my way through a 90-minute focus group, giving feedback on a movie I had not seen for a $90 Amazon gift card.

But who in their right mind would sign up for an hour-long, one-on-one interview for a product or service they’d never heard of?

If you have a skilled interviewer on your team, there’s nothing more useful than the depth of a one-on-one interview.

Reduce Bias: Ask questions without leading the participant. Moderators should always stay neutral and avoid influencing the answers, even if they completely disagree with what the interviewee is saying.

Cover All Angles: Prepare a variety of questions that explore different parts of the topic to ensure that you gather a wide range of viewpoints.

Use Time and Resources Wisely: Plan interviews carefully. Plan a series of questions that will guide the interview and keep it flowing so that no one person can monopolize the conversation.

Spark Creativity: Encourage participants to be creative in their responses by asking open-ended questions that prompt them to think deeply and share unique perspectives.

Give Enough Time: Schedule interviews so there’s plenty of time for thoughtful answers, not just quick responses.

Stay Flexible: Don't be afraid to deviate from your main questions and explore exciting topics that come up during the interview.

Analyzing Customer Data

So you’ve talked to some people and gathered some opinions. Now what?

I like to keep in mind a quote that’s widely attributed to David Ogilvy:

“The trouble with market research is that people don't think what they feel, they don't say what they think, and they don't do what they say.”

― David Ogilvy

So you’ve asked people what they think of your product, and they’ve given their opinions. Amazing! Now we have to see what they’re actually doing and compare that to what they’ve said.

The best place to start is in your own backyard. Who’s already bought from you? What data do you have on their buying patterns?

Always start there and work backward.

Purchase History

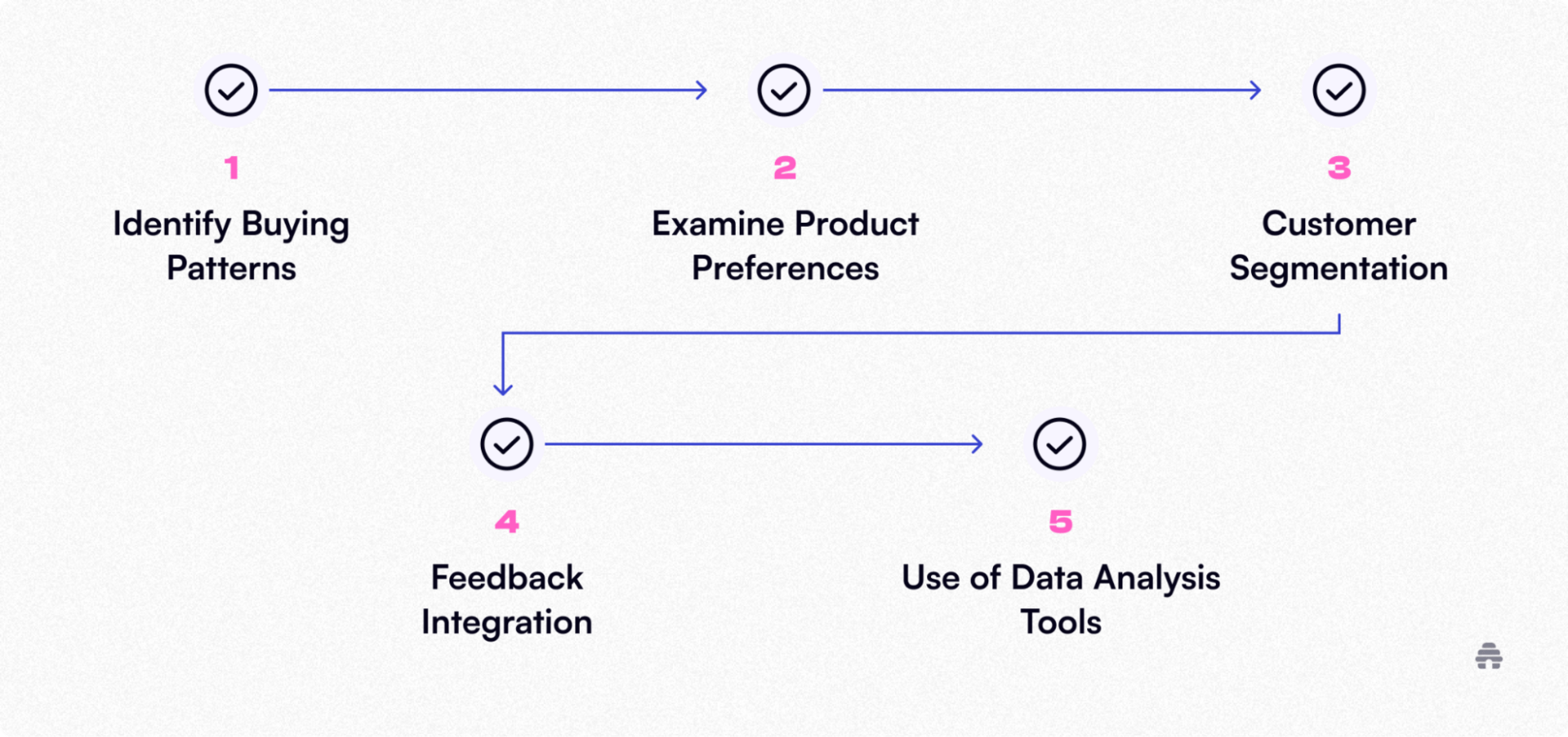

If you're new to analyzing your purchase history, here are five steps any beginner can follow:

Identify Buying Patterns: Look at your sales records to see trends in what customers buy, how often they shop, and how much they spend. A deep dive here helps you understand what products are popular with which customers and who your most frequent shoppers are.

Examine Product Preferences: Analyze which products are frequently purchased together or are popular among certain demographic groups. This will help you create product bundles down the road!

Customer Segmentation: Divide your customers into groups based on their purchase behavior. Group your big spenders into one category and your small spenders into another.

Feedback Integration: Use customer feedback from reviews and ratings to understand how satisfied customers are with their purchases. As you look back, you can use this data to refine product offerings and up your customer service.

Use of Data Analysis Tools: Utilize tools like Google Analytics to track which products your customers view most or how they navigate your online store.

Website Analytics

It's easy to get frustrated by the massive amount of data that even the most basic website generates.

Luckily, several services can help you dive into what's going on and get a better picture. All of them can help you gain a better understanding of your user behavior.

I've arranged them from most to least user-friendly:

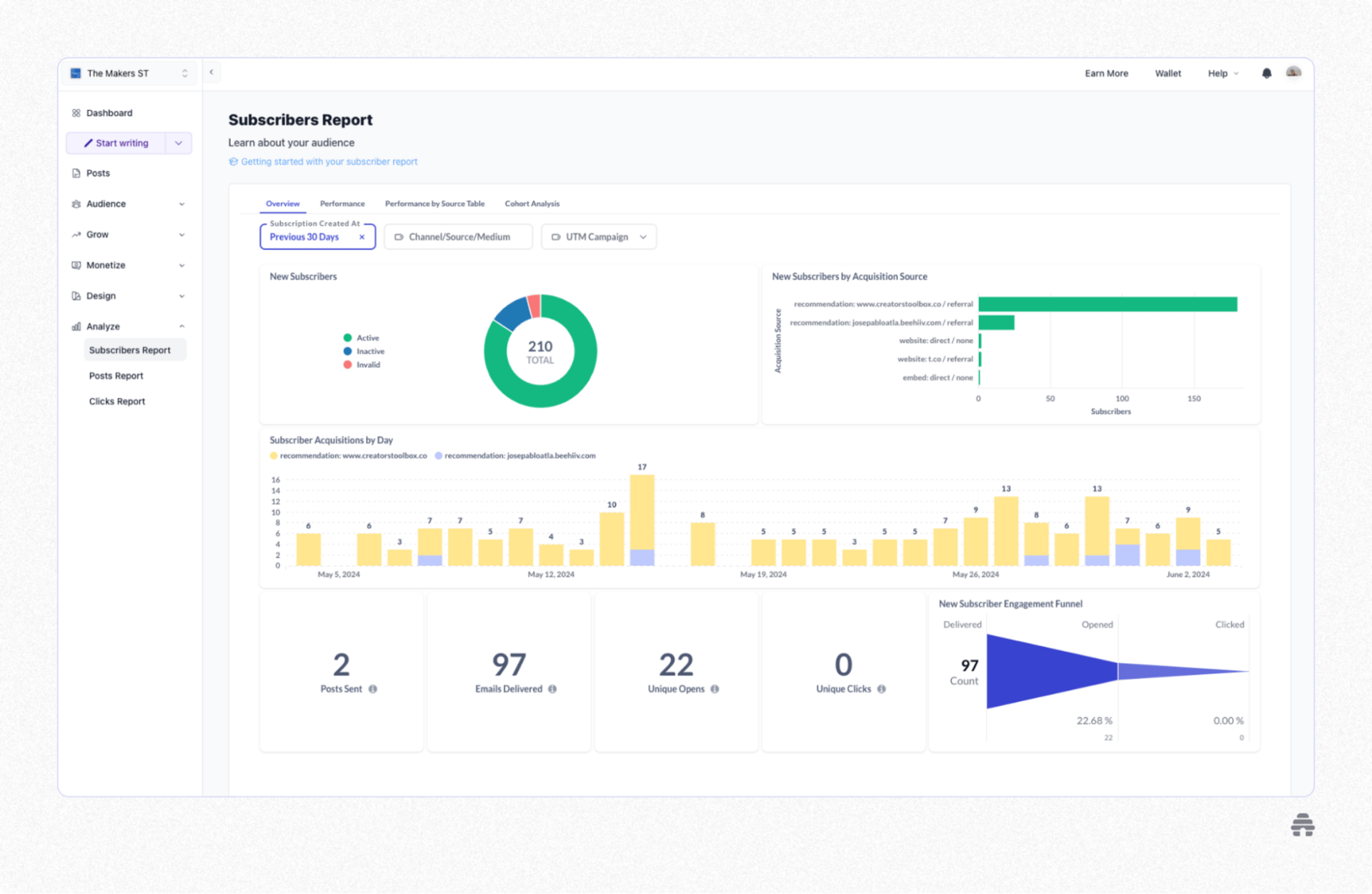

beehiiv 3d analytics: There’s no better way to get into the nitty-gritty of what’s happening with an email list than the beehiiv dashboard. You’ll have access to easy-to-understand analytics and hundreds of articles and guides to help you dive deeper than open and click-through rates.

Fathom Analytics: Fathom is known for its simplicity and ease of use. It offers a straightforward dashboard with crucial insights and no overwhelming data. It is privacy-focused and GDPR, CCPA, and PECR compliant, and its import feature allows for easy migration from Google Analytics.

Plausible Analytics: Known for its user-friendly and intuitive dashboard, Plausible is a privacy-centric analytics tool that provides essential insights without tracking personal information. It supports integration with Google Search Console and is popular among businesses that depend on user privacy.

Statsy: Statsy offers an easy-to-set-up dashboard and focuses on essential metrics, making it suitable for marketers, developers, and small businesses. It is notable for its lightweight script and real-time analytics. Statsy is GDPR compliant and offers a free plan for personal websites.

Piwik Pro: Piwik Pro offers robust privacy features and comprehensive analytics capabilities, including real-time tracking and full data ownership. It allows for extensive customization and is particularly useful for organizations with stringent data privacy requirements. Piwik Pro also makes it easy to create funnels that map the user journey through your site.

Google Analytics: Google Analytics is free (because Google wants you to buy ads from them) and powerful. However, it can be frustrating to get started with.

GA4 is NOT user-friendly out of the box. So if you're just starting out, I'd recommend hiring a freelancer on Upwork or Freelancer to get your tracking set up right between Ga4 and Google Tag Manager and then coach you on how to track your data properly.

You can also hop on Analytics Mania to learn more about it (I've known freelancers who solved problems that clients had been beating their heads against for weeks with a single AM article).

Creating Customer Profiles

So now that we’ve talked to people and looked through our purchase history to match up what they’ve said with what they do, where do we go from here?

We’ve got to split our data down to its component parts.

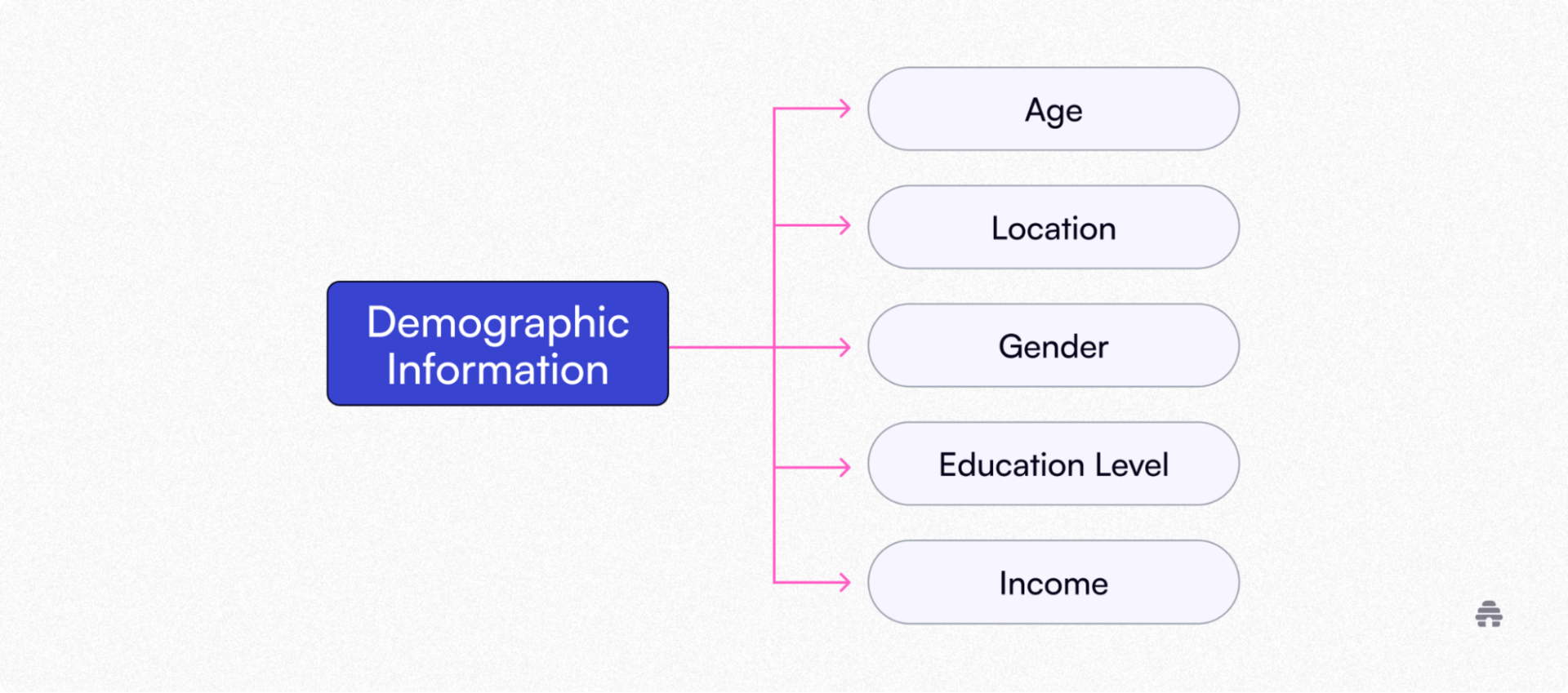

We’ll start by breaking our audience down into key demographics.

Demographic Information

Age: Segmenting your audience by age allows you to tailor marketing messages for people in different life stages. If you comb through your data and discover that your user base is far older than you thought, it might be time to change tactics!

Marketing strategies that appeal to millennials may not be effective for baby boomers. Younger audiences might respond better to digital and mobile-first strategies, while older demographics may appreciate more traditional media channels, like actual physical mail.

Gender: While collecting gender-based data can be challenging, it's crucial to understanding your audience. Not all analytics platforms provide accurate gender information, so collecting this data sensitively and inclusively is important.

Recognize that interests can vary widely within gender groups. With that in mind, customizing product offerings and marketing messages to different gender identities can significantly increase engagement and sales.

Understanding gender differences can help you get the word out on the right platforms. For example, if your user base is primarily men, advertising on Pinterest, which has a user base of 69.4% women, would be unwise.

Location: Geographic segmentation helps tailor marketing to local preferences, cultural nuances, and climate-specific needs. You don't want to send an email with a free Slurpee coupon to your Alaskan customer base in the middle of the winter. They’ll feel misunderstood, and you’ll likely lose many of them.

That'll be irrelevant to all but the most hardcore masochists! Segmenting your users by location will help you plan advertising campaigns based on local weather conditions, events, or cultural preferences. Your marketing materials will be far more relevant.

Education Level: People with different educational backgrounds have other interests and values, which can influence their purchasing decisions. Segmenting your list by education level can help you tailor your marketing content to resonate with your audience.

Highly educated audiences might appreciate more detailed, expert-level content than general, accessible content for broader audiences.

Income: Understanding your target audience's income levels can help your overall marketing strategy. If you offer a discount to everyone, most people will take it. Who doesn't love a sale? But for specific users, you may want to hold off on the discounts.

You can target higher-income consumers with luxury goods and premium services, whereas budget-conscious customers will be more responsive to promotions and discounts.

Behavioral Patterns

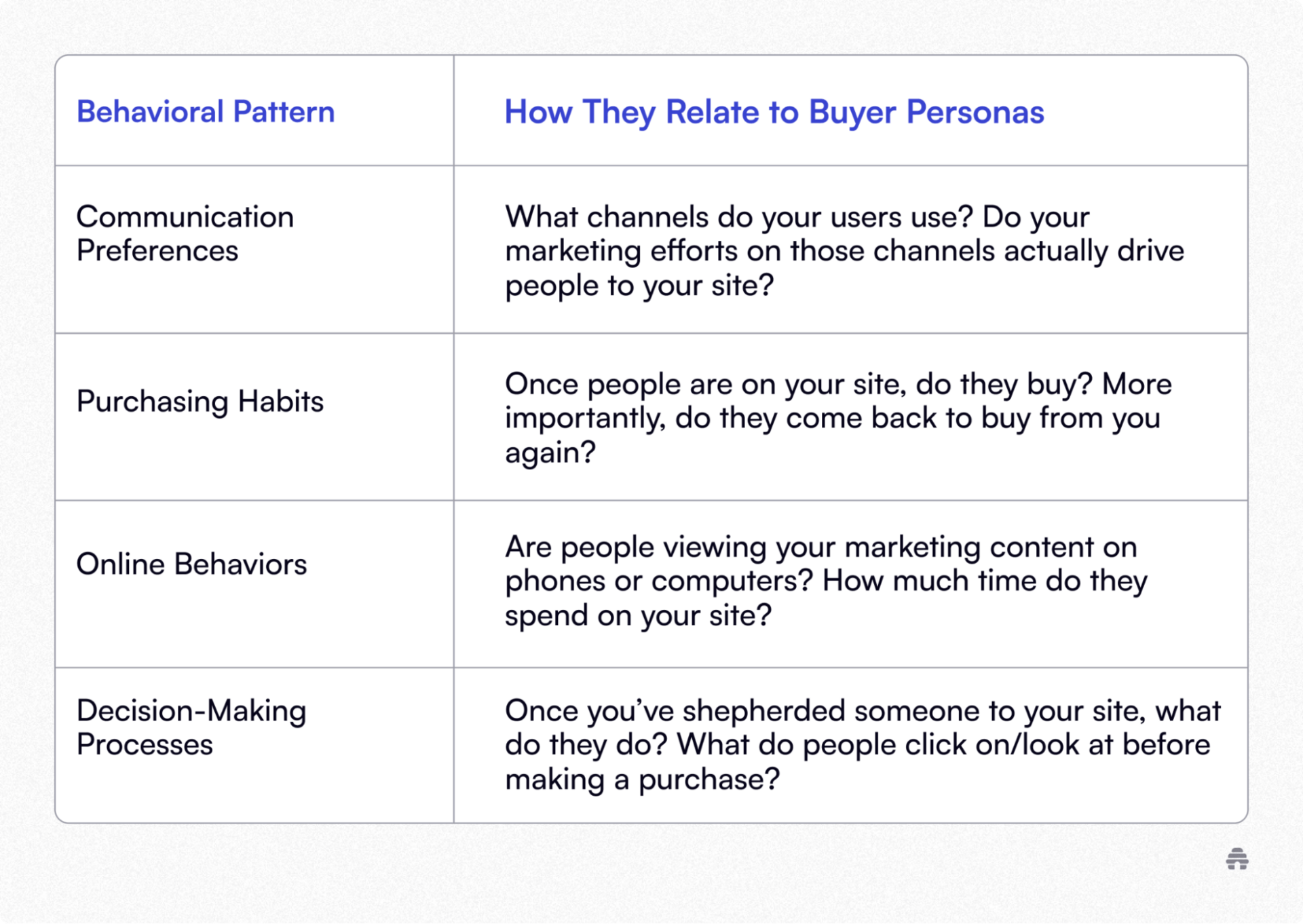

Now, for each group we created above, we’ll have to break the data down even further. Looking at everything we’ve collected so far (data from focus groups, interviews, analytics, and surveys), we need to start examining our customers’ behaviors.

The table below outlines how to use these to understand your users more deeply:

Buyer Persona Creation

After that arduous quest, we’re actually ready to make some buyer personas! We’ve collected all the key ingredients, and our data is segmented. Now, for the fun part…

Defining Persona Attributes

We’ve already segmented our data by age, gender, location, education level, and income level. Within each of those groups, we’ve analyzed behavior patterns.

Now, we need to get into the mind of someone in each of these groups we’ve created.

Let’s create an avatar based on the spaghetti example.

Our avatar:

Name: Alex Spaghetti

Description: Alex is a highly educated career person who loves to use what little downtime they have to cook with their family. They value food as a family bonding tool and routinely cook pasta. If shown a better brand of spaghetti and educated on why it’s “clean,” Alex would happily convert to our superior product. They spend a lot of time reading food articles online and planning recipes with the family.

Ways they find information: Food blogs, Instagram, TikTok food influencers, and Pinterest (as a way to save recipes).

Demographics:

Age: 40-45

Gender: N/A

Location: Midwestern U.S.

Education level: Master’s degree

Income: 100,000+

Pain Points: They love to cook pasta with the family but haven’t found a store-bought pasta that’s as good as homemade pasta. They’d happily pay more for something non-GMO with clean ingredients, but no one is serving them!

Needs: A better pasta (though they don’t know that’s what they need yet)

Drivers (Motivations): Being a great parent, family bonding, and spending time with their family

Congratulations! You now have a fully fleshed-out buyer persona!

Buyer Persona Utilization

I’d like to congratulate you for getting this far. You’re on the right side of the statistics! Only 44% of marketers claim to use buyer personas in their work, so you should commend yourself for creating one. 71% of companies that exceed their revenue goals use buyer personas; so by doing this work, you’re moving your organization in the right direction! Pat yourself on the back.

Now, how do we use this darn thing?

Content Marketing

We now know exactly where our ideal customer hangs out online. So by using the avatar we created earlier, let’s create some ads and content that will speak directly to them!

We know that they’re highly educated, in a higher-than-average income bracket, and value family time. They follow cooking influencers and read cooking blogs for new information. Now let’s make a plan for targeting them!

Content Topics and Formats

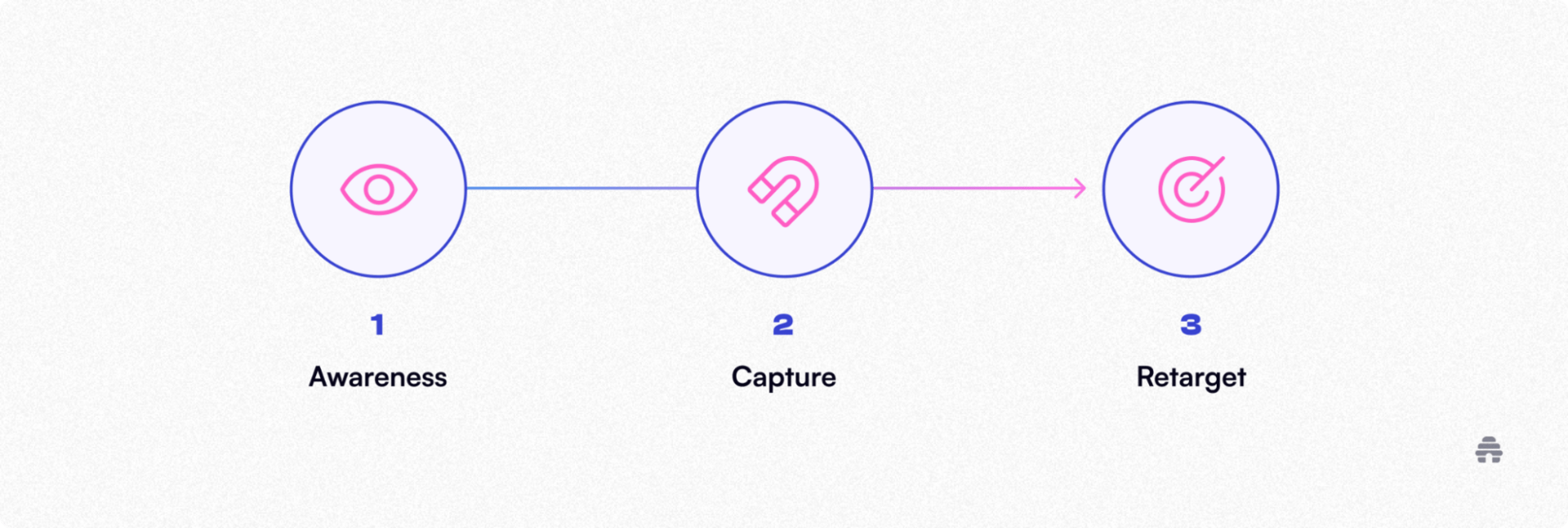

With everything we’ve learned about Alex Spaghetti, we’re going to use a three-part plan to engage that group:

Step 1: Awareness

We’ll use influencer marketing on Instagram to make them aware of our product. Then, we’ll target the same user group of that influencer’s followers with ads to drive traffic to our site.

Step 2: Capture

Users will land on our site from our targeted ads, where they’ll be treated to a knowledge feast. We’ll have in-depth blogs ready for them about why the ingredients we use in our pasta are superior, as well as testimonials from previous users who have fed this same pasta to their families and loved it.

We’ll offer a series of recipes using our spaghetti as a lead magnet and ask for their email in exchange.

Step 3: Retarget

Once we have their email, we’ll add it to our segmented list of people from the Alex Spaghetti campaign. We’ll re-target this list with family-friendly marketing and opportunities for buying in bulk.

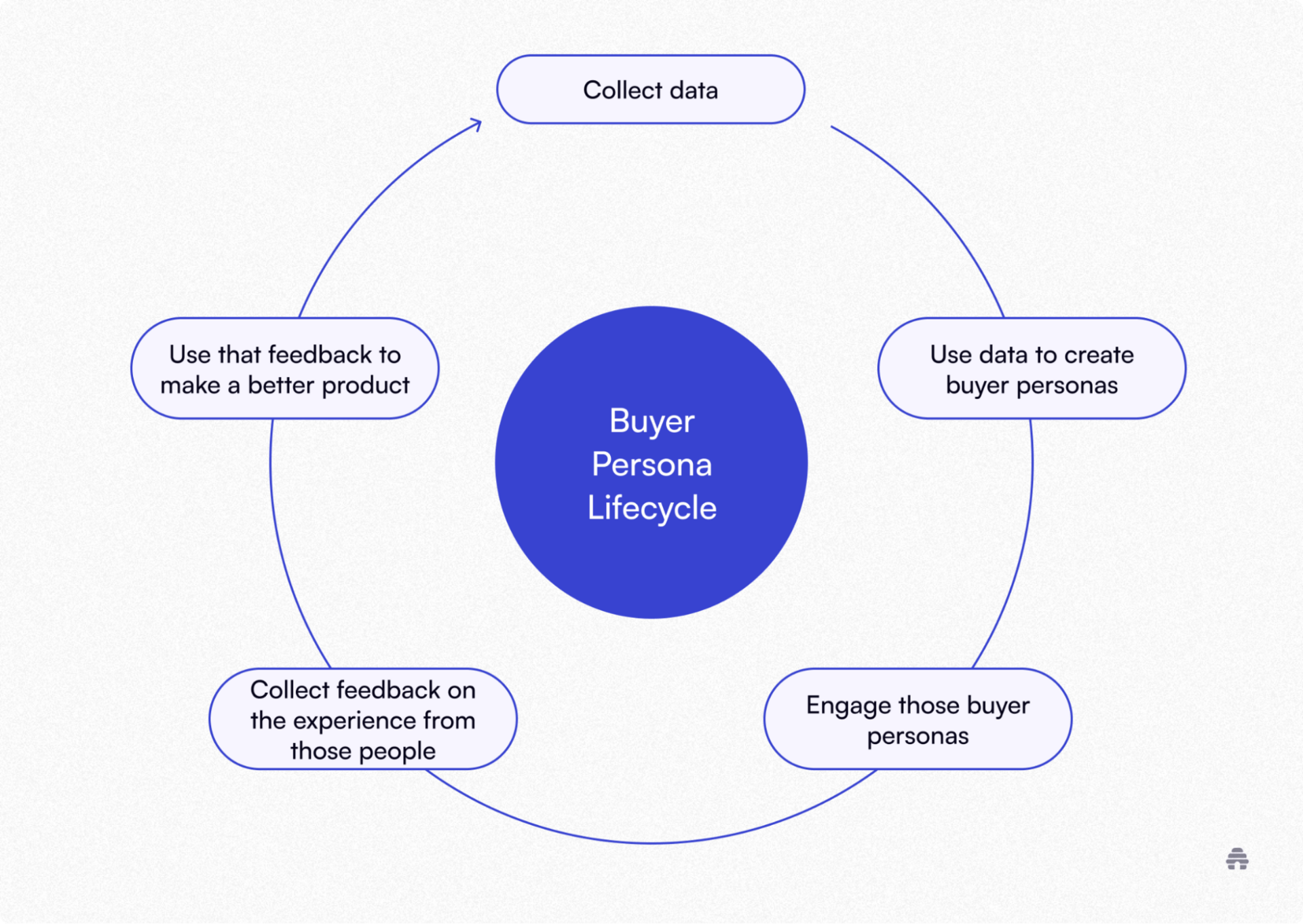

Product Development

The buyer persona lifecycle looks like this:

Every time you collect data, you have a better understanding of how your customers behave. When you ask them how you can make your product better, you’re telling them that you care. When you actually use their feedback to improve your product, you create lifelong loyalty.

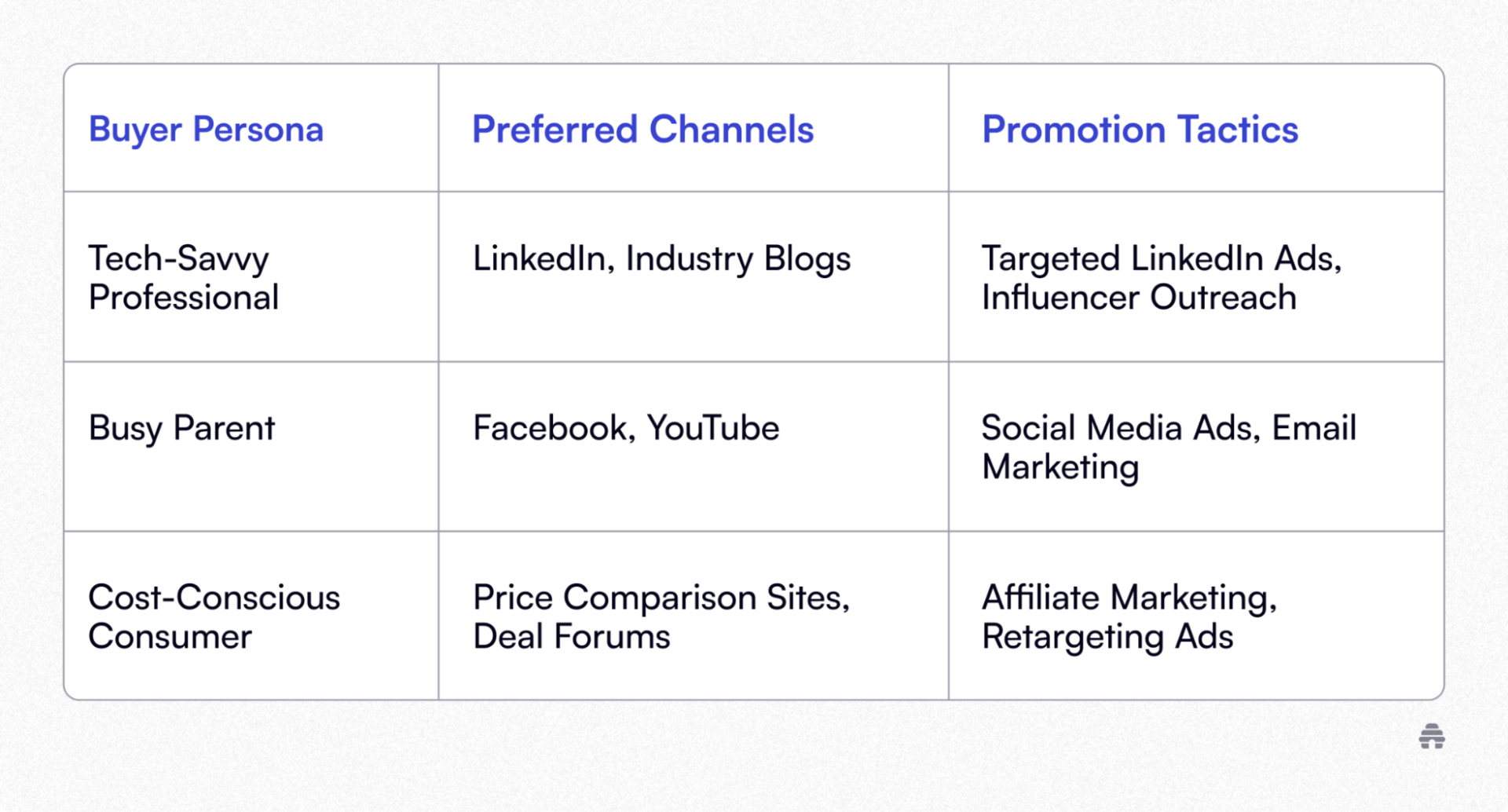

Marketing and Promotion Strategies

Whenever we’re engaging potential customers based on a buyer persona we’ve created, we need to always be thinking:

1) Where do these people hang out?

2) What kind of messaging will they listen to?

3) Why should they listen to us?

If you can answer those three questions, you’ll always be headed in the right direction!

Here’s another handy table as a reference for segmentation:

How To Master Buyer Personas -- Final Thoughts

Buyer personas start out as semi-fictional representations of your ideal customers. If you utilize and target them right, they become less and less fictional over time.

The most important thing is the evidence. If your buyer personas don’t match your data over time, ditch the personas first. Don’t be too attached to them! They’re a roadmap, not a holy scripture.

Ready to capture the kind of data that will make creating great buyer personas a breeze? Start your free trial of beehiiv!